Carlow had Leinster’s second-highest, year-on-year house price increase.

That’s according to Daft.ie which today publishes its analysis of recent trends in the Irish residential

sales market for the third quarter of 2021. (Read it in full here).

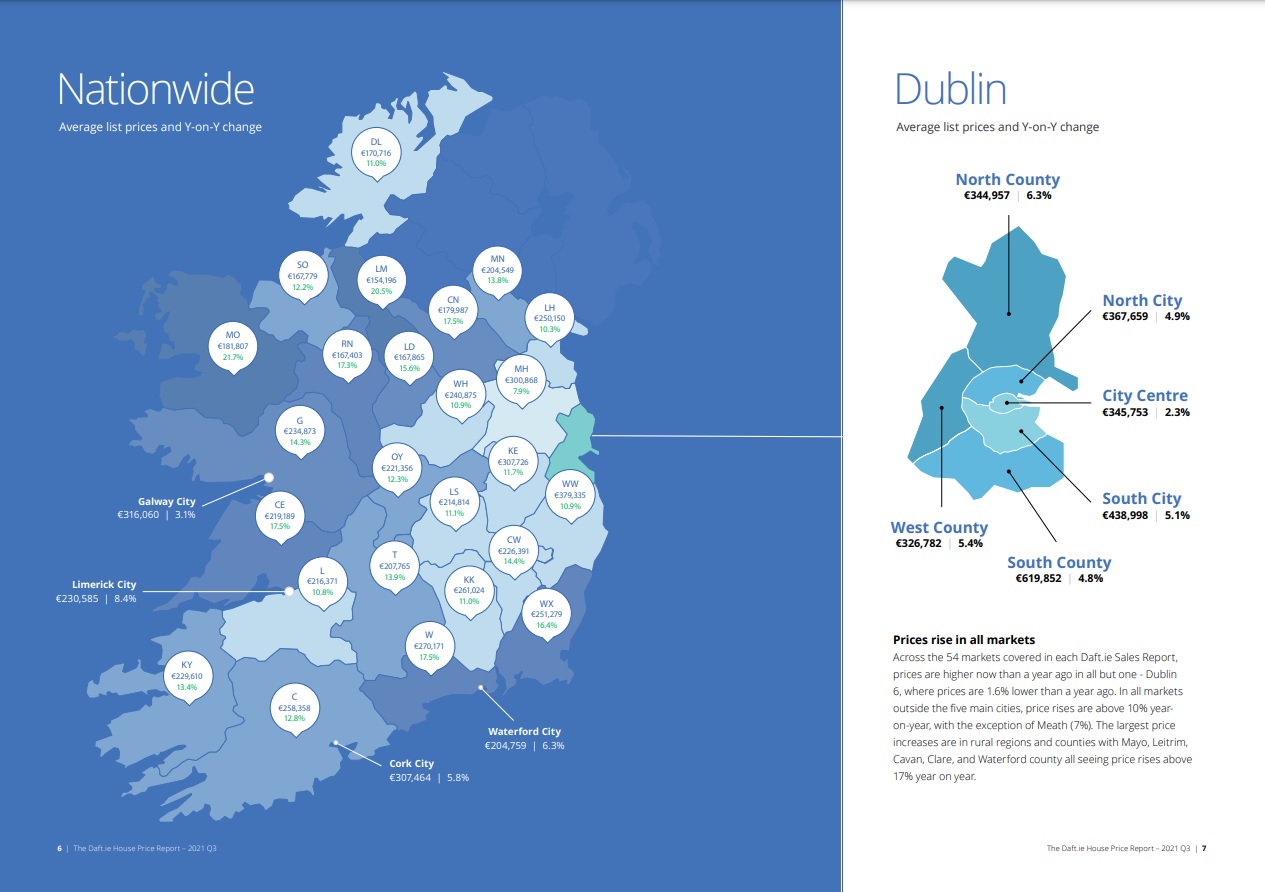

Compared to the same timeframe last year, the cost of buying was up 11.4% across the region. Kilkenny is in line with that at 11% to an average spend of €261,024 but Carlow jumped 14.4% to €226,391, behind Wexford’s hike of 16.4%.

Report author Ronan Lyons says it looks as though the worst of the inflation has passed as, though prices are still rising, it’s been doing so at a smaller rate in the last three months, telling KCLR News “There was a two and a half per cent increase in Carlow between June and September and only about half a per cent increase in Kilkenny and what it means is if you compare to a year ago prices are about 14% higher in Carlow and eleven per cent higher in Kilkenny, they’re obviously very big increases, relative normal healthy market but they are smaller than the increases that we’re seeing in June, if you look June 2020 to June 2021 the whole area we’re seeing increases of closer to 20%”.

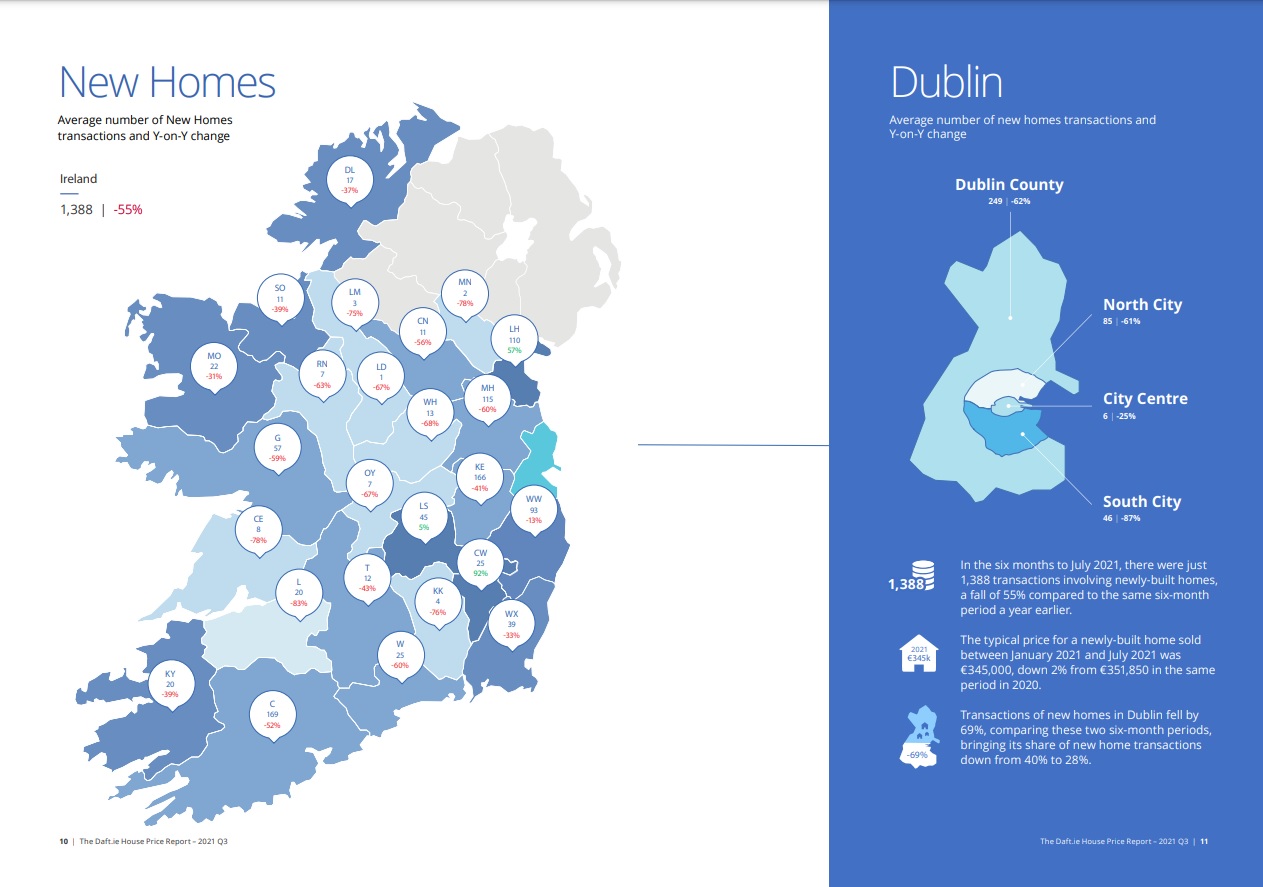

It’s as Carlow’s one of just three counties to record a rise in the number of newly built homes.

In the six months to July 2021, there were just 1,388 transactions involving newly-built homes across the country, a fall of 55% compared to the same period last year.

Kilkenny’s decrease was greater, at 76%, while Carlow, Laois and Louth were the only counties to record a rise in the number of such sales.

Report author Ronan Lyons says the effect of Covid is showing, noting “It’s been a funny market or a funny time in the new build market because the first six months of 2020 were the worst of the Covid pandemic in terms of restrictions on, for example, construction activity so there’s generally small numbers in the newly built homes especially outside the greater Dublin area so there’ll be a lot of noise in the newly built segment of the market that’ll settle down I think as, hopefully, we get back to normality and as construction rates around the country increase”.

Meanwhile, two other reports also out today show differing data.

You can view MyHome.ie‘s breakdown here

Their report says property prices in Kilkenny have mirrored the national trend and risen by €2,500 during the quarter.

The outline for Q3 2021, in association with Davy, shows that the median asking price for a property in the county has risen to €222,500. This is consistent with the overall national picture, which saw a quarterly increase in asking prices of 2%.

However, asking prices for a three-bed semi-detached house in the county fell by €2,500 over the quarter to €185,000. This means that prices in the segment have risen by €5,000 compared to this time last year.

Meanwhile, the asking price for a four-bed semi-detached house in Kilkenny fell by €12,500 over the quarter to €235,000. This represents a year-on-year decrease of €15,000 in the segment.

The number of properties for sale in Kilkenny on MyHome.ie rose by 22.1% in the last quarter.

The average time for a property to go sale agreed in the county after being placed up for sale now stands at just over five and a half months.

They say too that prices in Carlow have bucked the national trend and fallen by €8,500 during the quarter.

The report for Q3 2021, in association with Davy, shows that the median asking price for a property in the county has fallen to €209,000. This is in contrast with the overall national picture, which saw a quarterly increase in asking prices of 2%.

However, asking prices for a three-bed semi-detached house in the county rose by €1,500 over the quarter to €198,500. This means that prices in the segment have risen by €19,000 compared to this time last year.

Meanwhile, the asking price for a four-bed semi-detached house in Carlow fell by €19,750 over the quarter to €212,250. However, this still represents a year-on-year increase of €22,250 in the segment.

The number of properties for sale in Carlow on MyHome.ie rose by 14% in the last quarter.

The average time for a property to go sale agreed in the county after being placed up for sale now stands at just over four months.

REA Alliance‘s say:

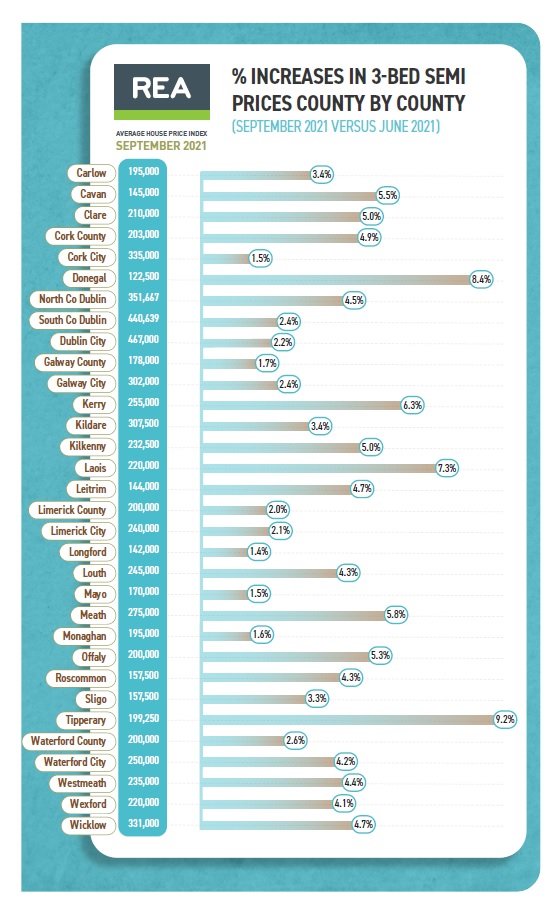

The price of the average second-hand three-bed semi in County Kilkenny has increased by 5% to €232,500 in the last three months, according to a national survey by Real Estate Alliance.

Homes in the county are reaching sale agreed in three weeks this quarter, the Q3 REA Average House Price Index shows.

The price of the average three-bed semi in Kilkenny City increased by 6.6% to €275,000 this quarter, with time taken to sell at just two weeks.

“There is a surge of interest from buyers in Dublin and expats wanting to come home,” said Michael Boyd of REA Boyd’s, Kilkenny.

“For one particular property, within three days we saw 90 mortgage-approved applications to view it.

“The reserve was 200K, and it went for €280,000 at an online auction on Bidnow.ie.”

Callan prices increased by 2.7% to €190,000 this quarter, and the average time taken to sell remained unchanged at three weeks.

“We are still seeing a strong demand in this area as high prices in Kilkenny city are making people look for more affordable houses outside of the city,” said Robbie Grace of REA Grace, Callan.

“Poor supply is an issue for purchasers, and lack of rental properties is an issue for people thinking of placing their property on the market.”

The grouping also says the price of the average second-hand three-bed semi in County Carlow has risen by 3.4% to €195,000 in the last three months, according to a national survey by Real Estate Alliance.

Across the county, homes are reaching sale agreed in three weeks, the Q3 REA Average House Price Index shows.

Prices in Carlow town rose 1.5% to €205,000 this quarter, with time to sell steady at three weeks.

“If a property is priced correctly, we are guaranteed 15-20 viewers, and we would have three or four bidders with reserve being matched or exceeded,” said Harry Sothern, REA Sothern, Carlow town.

“In August and early September, a number of people went on holidays and the market was not as active, but enquiries are coming in stronger in the second part of September.”

Tullow prices rose 5.7% this quarter to €185,000, with time taken to sell remaining at four weeks.

“Lack of supply continues to be an issue, and currently there are very few starter homes for sale in the Tullow area,” said Matthew Conry of REA Dawson, Tullow.

“Good quality residential properties which are in rural areas and are close to good road infrastructure are attracting strong interest from Dublin buyers, who now have the option to work from home on a full or part-time basis.”

Average house prices nationally have risen by €3,500 per month since the end of June, with selling prices in commuter areas and small towns increasing by over double the growth experienced in the major cities.

The survey concentrates on the actual sale price of Ireland’s typical stock home, the three-bed semi, giving an accurate picture of the second-hand property market in towns and cities countrywide.

The price of a three-bedroomed semi-detached house across the country rose by 4.1% over the past three months to €264,056 – representing an annual increase of 12%.

The biggest rises in Q3 came in commuter counties (4.6%) and the country’s large towns (4.9%) as buyers continue to move out further from the capital in anticipation of long-term remote and hybrid working situations.

They are being joined by a surge of interest from ex-pats, anxious to return to Ireland after the pandemic, with more set to return when family homes become available.

The rural and commuter area increases are double those being experienced in Ireland’s major cities, with Dublin increasing by 2.3% to €467,000 and Cork, Limerick and Galway by an average of 2.4% to €281,750.

“The survey’s average of four weeks to sell should be even lower because, while bidding is fast and furious, vendors are not rushing to accept offers,” said REA spokesperson, Barry McDonald.

“With an exceptional shortage of stock, demand is being fuelled by an increase in mortgage-approved buyers on the market.

“The rural flight, which began during lockdown, shows no signs of letting up, even in the face of a return to office working.”